Wednesday, December 10, 2008

Senate Valuation

http://www.clubforgrowth.org/2008/12/how_much_does_a_senate_seat_co.php

Workers of the World Unite!

Referring the the person who bought the company in 2006,

"Republic’s sales tumbled to $40.3 million this year from $52.3 million in 2007 as orders from homebuilders dropped to $6.3 million from $17.9 million, the company said in a statement." --Bloomberg

I wonder if the workers have really looked over all their options. If they really think the company can work, have they tried making an offer to buy the company? Financing through banks would be difficult for sure, but they clearly have many supporters giving them donations and volunteering. What if these supporters made a loan package available for them to do a leveraged buyout of the company? The Union probably has some money as well to inject in a buyout. Since I haven't seen a financial statement, I can't give you an estimate for the valuation, but if I see any I will post a valuation.

Tuesday, December 09, 2008

Credit Defaults Swaps on Treasuries, McDonalds, and Britain

Financial Times 9/27/08

A more recent story from IHT.

"The cost of insuring U.S. government debt against default over a 10-year span is a record $55,000 a year for $10 million worth of U.S. Treasury securities, or 55 basis points, as the cost is commonly expressed. That is a fraction of the 4,000 basis points for an emerging market country like Argentina, where some investors fear a default could happen as early as next year."

"in Britain, the swaps rose to a record 104 basis points for 10-year debt."..."The implied risk of holding debt issued by McDonald's was 67 basis points for 10-year securities on Tuesday"

Even with a perceived increasing risk of default, the prices for Treasuries and the rates are still falling. Right now the 10 year Treasury is just above 2.50% and the 3 month has a yield very close to zero. Since an active market in credit default swaps is relatively new, we don't have any much experience with seeing a situation where credit default swap prices are rising and yields on the underlying are falling. But seriously is Britain more likely to default on its Sterling obligations than McDonalds?

A US Senate Seat, Priceless

In exchange for the Senate appointment, Blagojevich allegedly discussed obtaining:

• A substantial salary for himself at a either a non-profit foundation or an organization affiliated with labor unions.

• Placing his wife on paid corporate boards where he speculated she might garner as much as $150,000 a year.

• Promises of campaign funds — including cash up front.

• A cabinet post or ambassadorship for himself.

--Chicago Sun Times

"I've got this thing and it's f***ing golden, and, uh, uh, I'm just not giving it up for f***in' nothing. I'm not gonna do it. And I can always use it. I can parachute me there."

--Rod Blagojevich

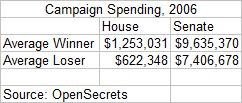

What does it usually cost?

Blagojevich was offering a bargain on something he didn't own in the first place.

When I have time, a valuation for a US Senate seat sounds like a fun project.

Monday, December 08, 2008

Made sense at the time

I guess now is the time to ask what were they thinking. Levering up a company that much to begin with is shaky. When it is in an industry that is in decline, even more so. Few newspapers have shown that they can make substantial revenue online, and paper sales have been falling. So many of these deals seem like they would only work in the best of circumstances, and really we should have seen this coming.

http://online.wsj.com/article/SB122868944355686385.html?mod=rss_whats_news_us_business

Wednesday, December 03, 2008

An Option to Buy Insurance

An interesting concept. Most of the time you don't need insurance. Most of the time it is easier just to pay the doctor in cash and not worry about claim forms. Other than the tax advantage, why should you fill out forms and have a third party payer for routine medical care. We do not fill out forms, show a food insurance card, and have a third party write the check at the grocery store. Insurance should protect against low probability, catastrophic risks in the tail of the distribution. When you really need insurance with this concept, you can acquire it.

Monday, December 01, 2008

The Great Wall

http://www.huffingtonpost.com/rep-jesse-jackson-jr/building-a-new-wall-the-f_b_146606.html

In a way, Jesse Jackson is correct in calling the U.S. Constitution a "wall." The purpose of the Constitution was and still is to prevent tyranny. The Bill of Rights contains the phrases "shall not" several times when referring to actions of the State and several other clauses restrain the State's actions by requiring due process. It is clear the Constitution and the Bill of Rights is intended to be a limitation on government, which is a wise decision.

We should not throw out this idea that government should have limitations. Even if a particular initiative is very popular, we must still consider whether the majority has a right to enforce the particular mandate on the minority. Too often people are wrapped up in whether a law helps a certain group of people or feels good and not whether it conforms to the principles of a free society, however interpreted.

Tuesday, November 11, 2008

Supply and Demand

Thursday, November 06, 2008

Limited Government

Government has moved from an independent body to prevent rights from being violated toward anything a majority says it is. While the Constitution has some room for interpretation, the wild interpretations of the Commerce Clause seem a bit much. The Interstate Commerce Clause allows the federal government to regulate commerce between the several states. The justifications given for many regulations follow from the Commerce Clause. The powers of the federal government as traditionally understood to regulate interstate commerce centered around prevention of states erecting trade barriers with other states. A second interpretation says that the federal government can place regulations on interstate commerce. A railroad that travels between several states or goods that are transported across state lines could be regulated. Up until the 1930s, these interpretations were the rule.

It gets complicated when the federal government tries to regulate things that are not interstate commerce at all. With the National Labor Relations Board v. Jones & Laughlin Steel Corporation decision the power of the federal government under the commerce clause greatly increased. After several decisions in the late 1930s and early 1940s, the commerce clause could be interpreted for almost any regulation desired.

Some recent decisions of the 1990s and early 2000s give reason for hope. United States v. Lopez (1995) challenged the Gun Free Schools Act of 1990. Lopez's defense said that the federal government did not have a right to regulate firearms in school zones. Therefore, the law was unconstitutional. The Court held "A law prohibiting guns near schools is a criminal statute that does not relate to commerce or any sort of economic activity." This case was the first one since the Great Depression to limit the power of Congress under the Commerce Clause.

If you think that the Commerce Clause can be interpreted to mean all things to all people then why was it even included. If you want to have the federal government step beyond its Constitutional limitations then amend the Constitution. Otherwise, we should just shred it as another meaningless document.

Wednesday, November 05, 2008

The Truth About Regulation and the Financial Crisis

- Substantial deregulation of financial markets took place under Bush

- This deregulation in large part caused the current financial crisis

Mr. Mankiw did taxpayers a service by wading into the debate over how to monitor these companies that have become repositories of enormous financial risk. Fannie in particular has marshaled its political troops to stop a bill in Congress that would transfer its regulation to the Treasury Department from a feckless unit of HUD. Fannie prefers feckless.

Specifically, "the subsidy creates a source of systemic risk for our financial system." This is because "the subsidy has allowed" the companies "to become gigantic," with their debt more than tripling to $2.2 trillion from 1995 to 2002."

Oh, but it gets better. "But especially notable is the support for Fannie and Freddie from liberals who normally detest corporate welfare. In this case, Congressman Barney Frank criticized Mr. Mankiw because he is worried about the tiny little matter of safety and soundness rather than "concern about housing."

Link to the article

For a problem as complicated as the financial crisis, it is not likely to be the only major cause. Looking at the evidence we see evidence that regulation was actually increased on Wall Street. The deregulation that did happen in the recent past probably prevented even worse consequences. One, Sarbanes-Oxley substantially increased the regulatory burden on companies. Under SarbOx, companies must mark certain assets to market. Even performing assets have been marked down substantially by banks. Since many of these assets are illiquid and difficult to value, they are often marked to a model rather than an actual market price(since a market price does not exist). Two, a substantial deregulation, the Gramm-Leech-Bliley Financial Services Modernization Act, enacted in 1999 under Clinton probably helped prevent an even worse disaster. This act repealed substantial parts of Glass-Steagall, and it allowed commercial banks and investment banks to combine. The universal banks have fared better in the recent crisis. I have a few more comments and links on another post.

I don't expect everyone to be an expert on regulation of financial markets. I certainly am not one myself. However, I do expect someone to actually have some facts about a situation before they argue a position. Remember, "Everyone is entitled to his own opinion, but not to his own fact"

I will continue to research this issue, and keep my readers updated.

Health Care Coverage

No government involvement in health care - All hospitals are privately owned and all health insurance is privately underwritten. In the most extreme case, doctors and hospitals would not be licensed by a government agency. Treatments and pharmaceuticals would be unregulated by the government. The only regulations that would apply to health care would be laws that apply to all other industries such as laws against fraud.

Regulation of practice and treatment - Doctors and hospitals must meet certain minimum standards set by a state or federal government. In the case of minimal regulation, harmful or useless pharmaceuticals and treatments are not allowed to be sold. Warning labels for some medications or treatments may be required by the government. Regulations for pharmaceuticals could range from minimal standards to extensive testing for efficacy on a certain condition.

Regulation of prices - Pharmaceuticals, treatments, or pay for doctors may be regulated by the government in order to keep prices down.

Regulations of private insurance markets - Mandates for coverage of certain conditions and perhaps requirements for deductibles. Rates or underwriting practices may be regulated by the state or federal government. In an extreme case, underwriting is basically outlawed with guaranteed insurance laws and community rating. The insurance may be mandatory, provided by employer, or freely purchased by individuals.

Government payment for medical care - In one way or another the government sets up an insurance program. These programs could range from coverage for specific groups or for an entire population.

Government provision of health care - A state agency owns and operates hospitals. With today's current system, some hospitals are government owned such as VA hospitals or county hospitals. In the British National Health Service, the government owns the hospitals and general practitioners contract with the National Health Service.

The US has a little bit of all of these systems to one degree or another.

I will post some information on other health care systems around the world shortly.

Monday, November 03, 2008

A Flawed Analogy

"I think when you spread the wealth around it's good for everyone." -- Barack Obama

Ok, if you're spreading the wealth around it's not good for the person having their wealth spread around. (People who pay taxes)

"I don't know what's next. By the end of the week, he'll be accusing me of being a secret communist because I shared my toys in kindergarten. I shared my peanut butter and jelly sandwich." -- Barack Obama

Nobody would accuse Obama of being a secret communist for sharing his own stuff. He wants to force you and I to "share" our stuff. Of course, it's not really sharing at all if the government locks you up if you don't share your stuff.

That is all for now.

Friday, October 10, 2008

VIX Rises Above 70

http://blogs.wsj.com/marketbeat/2008/10/10/the-soaring-vix/

We have gone from the VIX being at 10 in early 2007. Basically, the market didn't see risk anywhere. Now, under every rock and behind every door is more risk. Every major central bank and government is trying to fix this mess.

http://www.businessweek.com/investing/insights/blog/archives/2008/10/the_vix_could_t.html

Is it a bottom?

The decoupling of financial and real markets across the world was a myth. Every stock market that I can think of has fallen in the last couple weeks. Germany, Russia, Brazil, India, Iceland.

The real economies of emerging markets are still growing, but it is clear that they are slowing resulting in downward pressure on oil prices. Yet for some reason US Dollars and Treasuries are still in demand. Dare I say it, the long-term fundamentals of the United States are still good.

Monday, September 29, 2008

The Bailout

The Numbers - Hank Paulson, Secretary of the Treasury, is asking for $700 billion. It would start with $250 billion with the rest subject to Congressional veto. $700 billion is about 5% of the gross domestic product.

What would they spend the money on - Mortgage-backed securities and Collateralized Debt Obligations

- Mortgage Backed Securities - Cash flows paid out of principal and interest from mortgages. The buyers of these securities need to look at interest rate risk, prepayment risk, and default risk. They also need to look at the value of the underlying collateral in the event of a default in order to value these securities.

- Collateralized Debt Obligations - A special purpose entity created to buy fixed income assets(other structured securities, mortgages, bonds, loans). They are sliced up and sold to investors in tranches. The senior tranche receives payments first, followed by mezzanine, subordinate, and equity tranches. So, if the underlying asset does not pay off, investors in the equity tranche lose first.

What does it all mean? - Estimates of the actual cost of a bailout have varied. The securities that the government buys are probably worth more than zero. Some even say that the Treasury will make a profit on this deal like in the Mexican bailout. Some have asked where the government will get the money for this scheme. It will get money from where it always does: taxing, borrowing, or printing. At least right now, it is in a good position to borrow with treasury bond rates at very low levels. The Treasury can borrow at these low rates and buy these more illiquid securities, behaving like a very large hedge fund. Albeit, a hedge fund with other motives than return on investment.

If you have any questions about this situation or if you think I should cover more in this entry, post a comment or send me an email.

Thursday, September 25, 2008

Friday, September 19, 2008

Gramm-Leach-Bliley

Two links to Marginal Revolution

Glass Steagall: The Real History

Did the Gramm-Leach-Bliley Act cause the housing bubble?

The Great Depression brought about much financial regulation. Let us not make the mistake of hastily enacting new regulations just to be doing something. Remember the windfall profits taxes on oil companies in 1980, Nixon's wage and price controls, industry-wide cartels of the 1930s... You could fill volumes with examples of bad or ineffectual regulations that followed because people wanted to do something.

Thursday, September 18, 2008

Credit Default Swap in a few lines

So why should you care? There is an outstanding notional value of $65 trillion dollars of CDS contracts.

Quote of the day

-- Mayer Amschel Rothschild

More true today than ever.

Who, What, Where, Why, How?!?!?!?!?

Take a look at this treasury yield curve The 3 month rate is basically 0. The real rate is negative.

I'm not quite sure why you should buy treasury bonds right now. Basically, you are paying the government for the privilege of lending them money. Flight to safety seems overdone now, but where oh where to go? More at 11.

The LIBOR / 3 month treasury spread is up up up

Yes, it really is that bad -- Worst Crisis Since 30s

Wednesday, September 17, 2008

What to say

We are seeing the 3 month treasury bond yield at near zero.

When the government can borrow for nearly free and a nominal basis and a negative real interest rate, it's not a good sign. You cannot help but think of Japan when you see the rates this low. There are some parallels, but the actions taken recently have been different than Japan in the 1990s. In Japan, bad banks were propped up by the government. At least the bailouts here seem to be designed so that the common stock holders do not receive much. I believe the goal of the recent bailouts is different than the bailouts in Japan. I hope the goal here is to assist an orderly liquidation of assets rather than to protect the older and established companies and to keep up appearances.

AIG received an $85 billion loan from the Fed in return for 80% of the equity. The Fed now has control over AIG. The effects of this are being felt by the financial markets today.

"Banks abruptly stopped lending to each other or charged exorbitantly high rates Tuesday, threatening to spread the troubles of American International Group Inc. and Lehman Brothers Holdings Inc. to a broad range of financial institutions and the global economy."

"The depth of the money-market problems became clear at lunchtime in London, when the British Bankers' Association published Tuesday's Libor borrowing costs. Every day, 16 banks report what it would cost them to borrow at certain maturities and currencies. Overnight dollar Libor soared to 6.4375% from 3.10625%, the largest jump on record. Three-month dollar Libor rose to 2.876% from 2.816%."

If you are relatively informed on the recent events, I'd enjoy having a conversation about it to see what you think.

Friday, September 05, 2008

Links

I thought this post was quite interesting on valuing oil reserves. It talks about the real options and how NPV would undervalue oil reserves substantially.

http://www.marginalrevolution.com/marginalrevolution/2008/09/hail-giacomo-po.html

Hedge funds to the rescue

http://dealbook.blogs.nytimes.com/2008/08/27/hedge-funds-sprout-in-gaps-in-real-estate-lending/

Nanosolar raises $300 million

http://www.mercurynews.com/breakingnews/ci_10316469

A Few Observations on Financial Markets

Liquidity is not there when you most need it - In good times, there is liquidity for most people. Unless you are a giant player in the market, most of the time you can buy and sell without affecting the price much. You more or less know what something you own is worth. In times of poor liquidity, you have no idea what something is worth. When you are subject to regulatory requirements like banks or use high levels of leverage, you sell what you can sell as quickly as you can sell it.

Models are always wrong when they most need to be right - Models do not hold up under times of market stress. Maybe it is getting better, but knowledgeable people like Alan Greenspan basically say economic models are not any better than they were years ago. These models do not have much predictive power for the correlations between returns in situations of market stress. Remember that LTCM should have never lost so much money as it did in the history of the universe.

Similar things happen, but different enough where we don't know how to correct it in the future - All regulation tries to fix the last crisis in the markets. We never really know if a regulator was correct, but we know when they were wrong. We can never know the cost of lost opportunities due to excessive regulation and it is impossible for government to keep up with the dynamic free market. About every ten years, there is some new disruption in the market. Commodities in the late 1970s and early 1980s, leveraged buyouts in the late 1980s and early 1990s, Dot-com stocks in the late 1990s, and credit right now(also commodities and housing). Ultimately, we need creative destruction and it must be allowed to take its course rather than protecting everyone who lost money or might lose money.

Valuations come back to reality, but sometimes it takes longer than you can stand - Whether it is Dutch Tulips, Beanie Babies, or Internet stocks valuations will reflect fundamentals eventually. It is a question of when. Keynes said, "the market can stay irrational longer than you can stay solvent." Ask anyone who shorted Internet stocks in 1999. Within a bubble, many people know the prices do not make sense. They hope to make a profit according to the "greater fool theory" and get out before the prices fall back to reality. Not all bubbles could mean higher prices. The extremely low oil prices of the late 1990s did not seem to reflect the rising cost of exploration and production and the lack of new discoveries amid growing demand for oil.

I may develop these points in further blog entries with better examples and analysis, but this is a start.

Tuesday, August 26, 2008

USPS

So, why should government control the postal system? (it is allowed by the Constitution, but it is not an obligation of the government) FedEx and UPS have shown how private companies can effectively deliver practices and urgent mail. This competition has made the USPS better and more responsive. Why not end the monopoly on 1st class mail and bulk rate mail? This idea sounds radical to many, but there is no reason why it should be radical at all.

Repeat this for the Universal Service Fee on your telephone bill.

Stay Tuned

Sunday, August 24, 2008

On Ideology

For those who dismiss ideology all together, you are traveling without a map or direction. Usually whether one admits it or not, some sort of implicit ideology guides their voting and policy preferences. People have some approximation of the scope and role of government in society implied in their statements. John F. Kennedy said,

"What is at stake in our economic decisions today is not some grand warfare of rival ideologies which will sweep the country with passion but the practical management of a modern economy. What we need are not labels and cliche's but more basic discussion of the sophisticated and technical questions involved in keeping a great economic machinery moving ahead."

This assumes that the economy can be managed like a machine. Actual policy would embody even more ideology since it would endorse ends for the economy whether it's higher growth, a better environment, or more equality. Casually, people will say that he government needs to do x, or that y is none of the government's business. While most do not make their assumptions explicit, more people should in order to better comprehend a complex society.

Why is ideology rejected as such

- People have seen too many ideologies applied that do not fit society or human nature and cause much damage

- Exceptions to the rule are dealt with first and the whole package is discarded if it does not fit in every single case.

- People do not know what ideologies are out there and why they exist

Drew

Thursday, August 14, 2008

Some interesting stuff

VC Firm Subpoenas TheFunded.com

I suppose people we'll sue over anything. Although some VC firms may find that the truth hurts them more than it hurts TheFunded.com and its now anonymous posters.

Saakashvili: Russia controls a third of Georgia

So, what are Russia's intentions here? I should do a post about Russia. It would probably turn into a very anti-Russian rant though.

Bank analyst forecast Georgian Crisis Two Days Early

That is all for now

Famous Last Words

Great Depression - Many people including President Hoover said things like "Recovery is right around the corner." With better policies, it might have been, but that's a topic for a different post.

Bear Stearns - Tells investors that two of their hedge funds lost all of their value in July 2007.

CEO Jimmy Cayne says, “Most of our businesses are beginning to rebound." - October 2007

President Alan Schwartz - “We don’t see any pressure on our liquidity, let alone a liquidity crisis.

"We are in constant dialogue with all the major dealers, and I have not been made aware of anybody not taking our credit. None of that speculation is true.” March 10, 2007

Receives a bailout from the Federal Reserve and JP Morgan March 14, 2007

Uno Pizza Grill

The pizza chain, Uno, is in serious financial trouble. They have a $7.1M interest payment due on August 15, 2008. Despite their talk otherwise, they may not even know where the money is coming from the pay the interest and certainly even less so on the next payment. They are facing the possibility of a downgrade of their bonds to D.

Psallidas(CFO) - "We have a productive active dialogue going on with our bondholders"

Read the news stories on Bloomberg.

So readers, if you have any other good examples of 'famous last words' post away.

Saturday, August 09, 2008

Leaky Buckets and Doing Good With Other People's Money

First, you need to acquire the resources by taxing from someone who makes a higher income(or wealth) to give it to someone with a lower income(or wealth). An income tax creates a disincentive for producing and the capital gains tax reduces incentives for investing. Both result in a smaller amount of production now and in the future. Just how much is a question for the econometricians.

With a complex tax code like in the United States, incentives are in the tax code to invest in one thing as opposed to another. For example, municipals bonds are tax free at the Federal level and often at the state level. While this keeps rates low for municipalities, it diverts capital away from other uses. In absence of tax incentives for municipal bonds, more corporate bonds may be bought reducing the cost of borrowing for corporations. The price of lost innovation and production is really unknown with just this one example from the tax code. With a political system like ours, the tax system is bound to stay complex. Of course, nobody wants to pay taxes. So, we must have a government agency enforcing the tax code, investigating tax payers, and dispensing penalties. None of this is done for free. While I do not know what productive use an IRS agent would have outside of government, there may be one.

On the other side, welfare programs of all kinds have administrative costs. These programs need to set conditions for who receives payments and enforce that the truly deserving and needy get these benefits. None of this comes for free. As a parallel to the taxation side, the disincentives of welfare function in similar ways. Somebody who receives benefits knows that their benefits will be reduced if they work more. For some the psychological benefit of working and producing outweighs this loss of handouts. However, at the margins it can have an effect.

We have seen that transferring from the rich to the poor does not come free and this must be taken into account in the structure of tax and welfare systems alike.

Friday, August 08, 2008

Who Owns Big Oil?

When politicians attack big oil and threaten to slap a windfall profits tax on them, they make little sense economically. They also threaten the future of American's investments for their retirement and education. There is pain for millions of people that have difficulty affording high gas prices, but a windfall profits tax is not the solution. If you believe that the oil companies will continue to make high profits, set aside some money to invest in them. Even better if you use a tax advantaged plan like an IRA or 401K.

Thursday, August 07, 2008

Secular Bear Market

I would say that it is not if you want to beat inflation. First, if you are going to invest in the market, remember there is more than one market. The United States is a large country, but it is far from the only market to invest in. Emerging markets such as Brazil and India have seen stellar returns from 2000-2008. Exercise caution when buying into these developing countries though. They can only maintain high levels of growth for so long and their growth is dependent on a fast pace of reforms and opening their economies to outside investment. Your portfolio needs a wide variety of asset classes and countries represented. This secular bear market is likely to persist, the average is 17 years. The idea of secular bear and bull markets raises interesting questions of what causes long term trends in valuation and growth. I suspect much of it is based on changes in technology and industrial organization. I believe that the 1982-2000 boom was largely fed by technology helped in part by economic reforms to open trade and lower taxes. What could cause the next secular bull market? Nanotechnology, advances in space travel, low cost alternative energy, something else

Monday, July 28, 2008

Alternative Energy for Dummies

Advances have recently been made in solar to bring down the cost to a more reasonable level. Costs for photovoltaics have dropped from $27 per installed peak wattage to $4 per installed peak wattage recently. A company called Nanosolar, funded by the founders of Google, has technology to print solar cells at much lower cost. They claim they will be able to profitably sell them at $1 per installed watt quite soon. This technology could be deployed across large parts of the southwestern United States. This new solar technology combined with better storage and power transport technologies could spur a switch to solar energy.

The price of wind generators has also fallen greatly in the last few decades. Major companies like GE and Siemens as well as dedicated wind generation firms like Vestas. Generator technology is mature technology. However, many improvements have been made in blade design and materials, gearing, and computer controls. Billionaire oilman T. Boone Pickens is currently investing in the world's largest wind farm with over 2,000 turbines. In some areas, prices can rival coal or nuclear. With better storage and grid technologies, wind can provide a large amount of useful energy.

For automobile transport, we'll need either better batteries or some sort of manufactured liquid fuel such as hydrogen. Battery technology is improving quickly, and this means acceptable range and fast charging times with falling prices for batteries. Hydrogen fuel cells for cars do not seem practical in the near future. In addition to a workable battery technology, we need plentiful electricity. For the long-term this will need to be based on a renewable resource such as solar or wind. As for air transport, it's not quite as easy. Batteries do not have anywhere near the power density for air travel. Hydrogen could be manufactured for aircraft use provided there is cheap energy and a way to store it.

Biofuels might solve both the transport and the collection problem. While current technology with corn ethanol is expensive and requires huge inputs of energy, it might be better in the future. There are also a number of other technologies on the horizon. Algae can produce bio diesel and bacteria can produce a very high quality of crude oil. This technology is quite promising in that it would not require a shift in technology by users of energy. We could continue to use our regular automobiles and airplanes while using a renewable feedstock.

While there may be pain in the near term with higher energy prices, new technologies are promising. We must not be tempted to reduce the pain by price controls or subsidies that will only prolong difficulties. High prices more than anything else will make us switch.

Saturday, July 26, 2008

Whack-A-Mole for Economic Fallacies

Returning to the idea of "green collar" jobs, we must remember that jobs are a cost. Giving someone a "green collar" job takes away resources in a very real way from another industry. For example, engineers, computer scientists, and construction workers among others are needed to create a wind farm. A mechanical engineer might design aircraft engines instead. A computer scientist could work for Google instead. Construction workers could build a road or a bridge. We are likely in a recession now, so the costs of giving someone a job may be lower. Instead of collecting unemployment they could be at least be doing something useful. A recession is only temporary though, and government programs and subsidies long outlive their usefulness. Government will end up picking winners, and the rest will be left behind paying the costs.

Tuesday, July 22, 2008

How should history judge leaders and public figures?

"Let me give you a very simple example. Take the minimum wage law. Its well-meaning sponsors -- there are always in these cases two groups of sponsors. There are the well-meaning sponsors and there are the special interests who are using the well-meaning sponsors as front men. You almost always when you have bad programs have an unholy coalition of the do-gooders on the one hand and the special interests on the other. The minimum wage law is as clear a case as you could want. The special interests are, of course, the trade unions, the monopolistic craft trade unions in particular. The do-gooders believe that by passing a law saying that nobody shall get less than $2 an hour or $2.50 an hour, or whatever the minimum wage is, you are helping poor people who need the money. You are doing nothing of the kind. What you are doing is to assure that people whose skills are not sufficient to justify that kind of a wage will be unemployed. It is no accident that the teenage unemployment rate – the unemployment rate among teenagers in this country -- is over twice as high as the overall unemployment rate. It's no accident that that was not always the case until the 1950's when the minimum wage rate was raised very drastically, very quickly. Teenage unemployment was higher than ordinary unemployment because, of course, teenagers are the ones who are just coming into the labor market -- they're searching and finding jobs, and it's understandable that on the average they would be unemployed more. But it was nothing like the extraordinary level it has now reached -- it's close to 20%."

We cannot read the motives of politicians and they will always try to sell their motives as pure. So, we should lean towards judging by the results achieved in the actual application of policies and in an overall economic system. Looking at India, we see politicians that said they wanted self-sufficiency or to help the poor. These policies failed and created insurmountable bureaucracy was created that slowed economic growth and kept almost everyone poor. They saw planning as the way to do this, but they failed miserably and they are to blame. Even if we assume their motives were on the whole good, which I doubt, their actions resulted in the unnecessary poverty for millions of people. Planning crowded out the real benefactors of mankind. India did not need another 5-year plan or subsidies for low productivity domestic industries. They needed a Bill Gates, a Rockefeller, a Larry Ellison, but these types of people were crowded out and the entrepreneurial, profit-seeking spirit was strangled and replaced with rent seeking, over planning, and a system that kept India in the past for so long.

Saturday, July 19, 2008

Hedging the End of the World

For those of you that don't know anything about credit default swaps, basically it is a contract that says I will pay you if the underlying creditor defaults. So, I substitute my credit for the underlying.

1. Company or government issues a bond

2. I write you a contract that says I will pay you if that company or government defaults (doesn't pay up)

3. The company or government defaults I pay you the value of the bond. Typically, I would pay the value of the bond minus the recovery amount from selling the firm's assets to satisfy creditors.

The notional value of credit default swaps in the world is huge; it is estimated to be $62 trillion and most people have no idea about credit default swaps. Granted most traders in CDS probably do not have huge exposures, since they are in offsetting position. Let's suppose an investment bank writes a swap on a US Treasury. The idea of this leaves me wondering what event makes the Treasury default and leaves the investment bank(counterparty) able to pay. Since the credit default swap can be seen as a form of insurance, and insurance is only as good as the insurer. We have seen trouble with the municipal bond insurers, "By January 2008, many municipal and institutional bonds were trading at prices as if they were uninsured, effectively discounting monoline insurance completely." (Wikipedia) The credible rumor of a default by the US Treasury would damage any counterparty and a default would be the financial equivalent of the end of the world.

If you buy a credit default swap on the US Treasury, it is like you are buying insurance on the end of the world. How do you price this and should you really assume anybody will be around to pay up?

Thursday, July 17, 2008

Is Healthcare a right?

First, you need to look at health care as a continuum. The poorest people in the world have zero or very close to zero healthcare. The richest can get the best doctors, procedures, and drugs instantly without any thought of the cost and little or no waiting time. Most Americans rely on employer or government provided health care with some waiting, deductibles, and paper work. Does everyone have the right to the same level of healthcare? If that it is the case, we will probably have to restrict the health care choices of the richest people since a government provided plan would be insolvent if it tried to provide the best of the best healthcare for everyone.

Looking at the high price of health care, we see that a large amount of the expenses are incurred in the last year of life and much of that in the last quarter. This sort of healthcare does not add much value, and there are many patients that would be more comfortable and better off spending their last days at home. Some of this healthcare spending is out of the desire to do something rather than nothing even when it would be better to do nothing at all. Healthcare adds much value in antibiotics for infections, vaccines, treating some traumas, hip replacements, and probably quite a few other areas. With developments in materials, nanotechnology, and biotechnology healthcare, at least in the short run may become more expensive if you want the absolute best money can buy. Like other technologies we may see a decrease in prices at some point even if the system is confounded by the third party payer issue, which I will discuss in a later entry.

Once, I went to the doctor after feeling ill for several days. After the doctor listened to my lungs and ordered a chest x-ray, I was admitted to the hospital for two days and administered IV antibiotics. When I began writing this entry, I was thinking about the different levels of care that could be administered in this case. Unless I was truly destitute, without a cent or credit to my name, I would not have been able to go to the doctor. However, even someone without health insurance in most cases could find the money to go to the doctor to get something checked out. People are generally not in a vacuum; they have access to friends and family, credit, and their own savings to pay for medical expenses. At least they should have the resources to pay for doctor visits and relatively routine medications. They may not have been up for being admitted to the hospital, but they could still knock out the infection with antibiotics. Of course, there are exceptions to this and everyone has heard an anecdote about health care in the United States. However, life expectancy in the United States is not all that bad. It is much publicized that American’s life expectancy is lower than other industrialized countries. However, much of this could be due to habits and demographics rather than an inferior health system. In any case, at least in life expectancy there cannot be too much inequality for the simple fact that there are no people walking around living 200 years or more skewing the average up.

Saturday, June 07, 2008

For Lack of a Plan

Austrian economists predicted the economic troubles of the Soviet Union and the reason why communism would not work. Prices for economists are not just what is listed on the sticker. All prices are signals. How scarce is something and how much do people want it. Soviet prices did not reflect any underlying realities or signals. Under the Soviet system, some goods accumulated with few buyers while lines formed for other goods. Here is a line in Poland for a store that recently received some toliet paper. Hundreds of thousands of prices were set without much regard for efficiency, the scarcity of raw materials, or consumer desires. The Soviet economy could not even provide decent quality consumer durables like refrigerators, televisions, and washing machines. Even with a good plan that produced "enough" consumer goods, the plan would leave little room for the unexpected. I suspect that many innovations of the 1990s that we now take for granted would not have been part of the plan.

Friday, April 04, 2008

Perspectives on Subprime

The first question, does the government have a role in fixing the subprime crisis? The panelists certainly did not agree with each other. The argument against government action was primarily philosophical--borrowers and lenders are responsible for their own mistakes. The practical considerations basically came down to the fact that the government would probably make it worse and there would be unintended consequences. For the panelists in favor of some government action, they argued that the dead weight losses from houses falling into disrepair and the like are substantial. The panelists against government action replied another man's loss can be another man's gain. Some investors bought contracts that increased in value if borrowers defaulted. Other investors were able to pick up cheap properties. They question whether government should pick winners and losers.

Since this panel was stacked with conservatives and libertarians, throwing piles of money at the problem was not on the table. I wish it were so for conservatives in Washington. For the panelists that saw a significant role for government, they believed that encouraging renegotiation of lending terms could help. While this idea sounds good to many people, there are some additional consequences. What happens to lending markets and securitization when the government intervenes and sets a precedent? Players in the mortgage markets, long and short, might have an even more difficult time with their models once the government changes the game.

On the Democratic side, voluntary cooperation has already been thrown out the window. Clinton wants to freeze rate increases and force a moratorium on foreclosures. Clearly, people who are defaulting on their mortgages would be pleased with this solution. However, the borrowers agreed to their loans. They could have rented a home or bought a smaller home instead of overextending themselves. While there were cases of unsavory characters in the mortgage industry, most the responsibility lies with the people who borrowed. The borrower has some obligation to know how much they can pay and the risks of a particular type of mortgage.

Regulation might be able ensure that defaults are extremely low in the future, but there is a big problem with this approach. We only have to look to Japan, Italy, or Argentina where it much more difficult to get a mortgage. First-time home buyers much save for a long period of time to even afford a down payment. Home owners find difficulty in getting loans on their homes to start a business. More regulations might make it more predictable and lead to fewer foreclosures, but even that is far from certain. Certainly, it would lead to a reluctance on the part of lenders to take risks on borrowers with short or patchy credit histories. Yet another unintended consequence.

Wednesday, April 02, 2008

Hearings on Big Oil

Let us begin with the numbers. Congressman Ed Markey (D) was outraged that the 5 oil companies represented made 123 billion in combined profits. Even if we grant the assumption that it is the Congress' job to regulate their profits, we find out that the profits are reasonable by any standard. Last year Exxon made 404 billion in revenue. Their net income was 40 billion, or about 10 percent. See for yourself, read Exxon's annual report. While this percentage is higher than many industries, it is certainly nothing to be outraged about, especially when you consider that the industry reported extremely low profits throughout the 1990s. A 10 percent net margin is a small price to pay for the management, engineering, and capital that brings refined products to the consumer. Then look at where the profits went. In Exxon's case much of the profits were used to repurchase stock or pay dividends. While the Congress has the image of Wall Street fat cats collecting all of these dividends, it is not the case. Read this study on the ownership of "big oil".

I admit that I do not know much about the tax laws for oil companies, but the financial statements show that oil companies pay a substantial amount in taxes. Exxon paid nearly $30 billion in taxes last year. Any well-bred libertarian would be against unfair tax breaks and subsidies, but it seems oil companies pay quite a bit already. If we want to attack industries with subsidies, few have their hands in the pot more than "Big Corn" with the ethanol hoax and countless farm programs. I believe it would be extremely poor policy to raise corporate taxes when countries around the world are lowering their taxes. The United States should not make it more expensive and difficult to compete.

The Congressman want a tithe (10% of their profits) at the altar of alternative energy from the oil companies. While we will move towards other sources of energy and energy storage, we do not know which technologies or companies will succeed. We could force the oil companies to invest in alternative energy or have the Congress ask very nicely, but it is yet another case of seen and unseen. We would see the additional investment in alternative energy, but we would not notice the oil companies drawing capital away from smaller and more innovative companies in the alternative energy sector. Think about this question for a minute--Is a gigantic, lumbering oil company that is optimized to efficiently refine and transport refined products the best vehicle to research and develop new technologies? Perhaps not. The leaders in providing energy in the future are probably companies few people know.

Let the markets and creative destruction work.

Finally, the Congressmen do not understand prices. They seem unwilling or unable to grasp what a price means. Many of the Congressmen were concerned about climate change from the use of oil. Ostensibly, the primary purpose of this hearing was climate change. Of course, a populist attack on "price gougers" was not far behind. Somebody should let the chairman of the hearing in on a little secret -- the law of demand. For people concerned with climate change, they should welcome the latest price increases in the price of gasoline and heating oil. While demand is rather inelastic for oil, people will change their behavior. In the short term, they drive less, buy more efficient cars, and buy better insulation for their houses. In the longer term, they might relocate closer to their workplace. On the supply side, the high price of oil is the best incentive for research in alternative energy. Pick up a copy of MIT Technology Review or search the internet for companies that are currently developing and improving solar, wind, biofuels, and energy storage technologies.

Coming soon, advice for anyone called in front of a Congressional hearing.